-

The most significant market data point is the increase in listing inventory. Year over year (2025 vs. 2024), inventory is up 24.8% in Sussex County and 59.9% in Bethany Beach. Additionally, the average days on market is 46 days, which has increased both month-over-month and year-over-year. Helping

Read More Luxury Outlook & Migrating Wealth

We appreciate the compliments to our newsletter! Our goal is to help readers find value and stay updated on the market. We are thankful to our editors and top brokers who refine our articles and market updates. While new contracts were down by 18% compared to last year, we're pleased to report a st

Read More-

Owning a luxury home or investment property in Coastal Delaware comes with breathtaking views and an unparalleled lifestyle. However, with the coast's beauty also comes increased exposure to natural disasters such as hurricanes, flooding, and severe storms. Preparing your property now can mean the

Read More -

I hope your New Year is off to a great start! Looking ahead to 2025, the real estate market will continue to evolve, shaped by political shifts, economic factors, and market dynamics. Another strong year is forecasted by leading financial institutions, following what appears to be a 5.2% national i

Read More Delaware Property Assessments: Navigating the Changes

You have probably been hearing about the ongoing property assessment process here in Delaware and wondering how this might impact your primary residence, vacation home, or rental property. To help you navigate this, we’ve distilled some of the most important points of this process below to help pro

Read MoreYear-end real estate tax strategies

As we approach the end of the year, now is a prudent time to review your real estate investments and ensure you're taking full advantage of available tax strategies. Proper tax planning can reduce your taxable income and position you for continued growth in the coming year. Let's look at some of th

Read More-

The average supply of inventory over the past five years is 2.7 months. Our current month's supply is 4.1 months. Still a seller's market by historical standards but this change is noteworthy. A balanced market is generally considered to have a supply of four to six months. As interest rates contin

Read More -

Whether you own a stunning waterfront property or a portfolio of investments, protecting yourself from legal and financial risks is a priority. A good friend recently ran into some legal issues with an investment property that could have been easily avoided with proper asset protection. This month,

Read More 2024 Mid-Year Luxury Outlook℠ | Sotheby's International Realty

We are pleased to introduce the 2024 Mid-Year Luxury Outlook℠ report by Sotheby's International Realty, which outlines the industry trends and happenings across high-end residential markets. This year, policy shifts and global elections across nearly 80 countries are likely to impact property marke

Read More-

Sales volume has increased 16% year-over-year and we continue to see a steady increase in inventory. We anticipate this trend continuing throughout the summer but our market still only has 1/4 the number of active listings during the same time of year prior to the pandemic (June 2019).As we approac

Read More -

Selecting a contractor with a proven track record ensures quality expertise, transparent pricing, and a stress-free experience. The same principle applies when selecting a moving company. Lately, we have witnessed some unfortunate situations with untrustworthy movers, which prompted me to write abo

Read More -

In conjunction with inventory rising by 24% throughout the first quarter, we also observed heightened buyer demand across many of our markets. Recent listings have frequently sold swiftly, often attracting multiple offers, particularly when competitively priced relative to market value. This unders

Read More -

As we navigate the early months of 2024, Sussex County homeowners and investors are exploring property taxes and how the increased assessments will be allocated.A closer look at property reassessments Delaware's initiative to reassess property values statewide is making significant strides, with Su

Read More -

As part of a partnership that began last fall, we are proud to announce that we have taken the next step in our collaboration by unifying our identities under the Monument Sotheby's International Realty name. This change allows us to provide an elevated client experience to our buyers and sellers o

Read More -

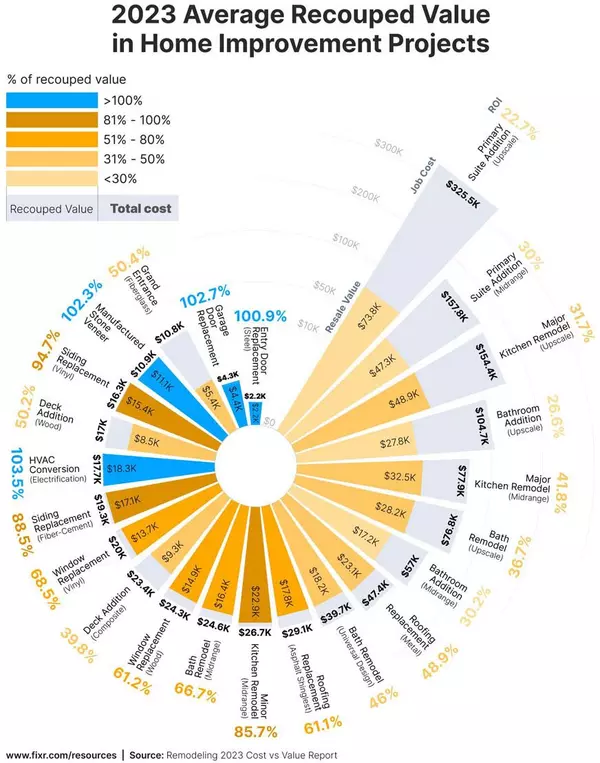

Selling a home or investment property is generally a straightforward task. However, a common challenge is determining what renovations are worth the effort and expense to optimize marketability — so you can get top dollar and make a profit. A recent Realtor.com survey shows that more than half of h

Read More Market Update & 2024 Luxury Outlook Report

As we begin 2024, we continue to see a lower than average inventory of existing homes for sale. Home prices rose faster in December than they have in more than a year. Falling mortgage rates brought more buyers into the market in December, but they faced the same challenges for the past two years, a

Read More-

The summer season is just about in full swing but sales are still down significantly. When compared to pre-pandemic times, it was common to have about 4x the number of homes on the market this time of the year. The year-over-year median purchase prices have increased by 17% but sales would certainl

Read More -

My wife and I recently took our children to the Caribbeans and our fantastic tour guide said something that I hope our kids never forget: "We have no problems, mon. Just situations, and we take care of them before they become problems." In 2002, I started my real estate career in the commercial off

Read More -

If you're evaluating real estate in a trust, refinancing, considering a sale, or need to know the value of your home for other purposes, an appraisal is in your future. To ensure the appraisal goes smoothly and your property is valued fairly, you'll want to do a bit of preparation. Depending on the

Read More -

With high inflation (though it's cooled a bit) and rising interest rates, the cost to buy or build a home is an issue of concern. Let's explore the comparative cost and advantages of building a custom home vs. buying a pre-built, conventional or modular build. A study by NAHB (National Association

Read More

Recent Posts